Table Of Content

Buying a home for a lower price or waiting until you have larger down payment savings are two ways to save you from larger monthly payments. Private mortgage insurance (PMI) is an insurance policy required by lenders to secure a loan that’s considered high risk. You’re required to pay PMI if you don’t have a 20% down payment and you don’t qualify for a VA loan.

APR vs interest rate?

To verify the details of the property, the lender will require an appraisal to assess the value of the home. In case that the appraised value is smaller than the price of the house, the lender will not approve the loan for the house’s price. Furthermore, the lender will check if there are any liens on the home’s title by hiring a title company. After your offer is accepted, you can start your mortgage application. At this point, the lender will need to verify all the necessary details relating to your income, employment, assets, and the details of the property. This process can be faster if you were already pre-approved for a mortgage since some of the documentation has been already collected.

What is an amortization schedule?

Also, ask your network of friends and family, and any real estate professionals you’re working with, for referrals. While a mortgage calculator is best for those looking to buy a home, it can also be used when refinancing your home or paying off a mortgage early. If this is your first time shopping for a mortgage, the terminology can be intimidating.

Monthly Payment: $1,687.71

When you use the Rocket Mortgage® calculator, it’ll factor in frequently overlooked costs like property taxes and homeowners insurance. The mortgage payment estimate you’ll get from this calculator includes principal and interest. If you choose, we’ll also show you estimated property taxes and homeowners insurance costs as part of your monthly payment. The NerdWallet mortgage payment calculator cooks in all the costs that are wrapped into your monthly payment, including principal and interest, taxes and insurance. The more info you’re able to provide, the more accurate your total monthly payment estimate will be.

Additionally, if you have an interest-only compoonent in your mortgage, then try using an interest-only mortgage calculator for a more precise payment schedule. Key factors in calculating affordability are 1) your monthly income; 2) cash reserves to cover your down payment and closing costs; 3) your monthly expenses; 4) your credit profile. Determining what your monthly house payment will be is an important part of figuring out how much house you can afford.

How Much Is A Down Payment On A House? - Bankrate.com

How Much Is A Down Payment On A House?.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

Variable vs. Fixed

4 Mortgage Apps To Calculate Your Loan Payments - Forbes

4 Mortgage Apps To Calculate Your Loan Payments.

Posted: Thu, 16 Nov 2023 08:00:00 GMT [source]

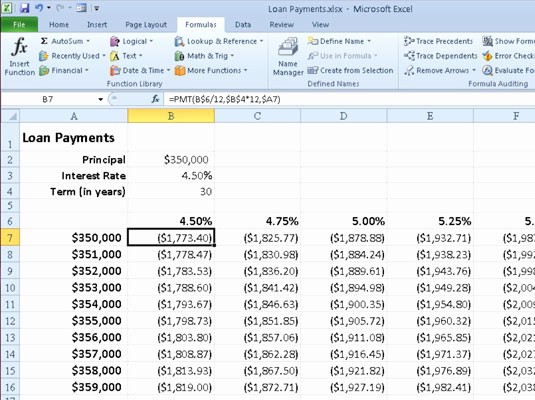

Adding different information to the mortgage calculator will show you how your monthly payment changes. Feel free to try out different down payment amounts, loan terms, interest rates and so on to see your options. Lenders use your debt-to-income (DTI) ratio to decide how much they are willing to lend you. DTI is calculated by dividing your total monthly debt — including your new mortgage payment — by your pretax income. To calculate the property taxes the borrower will have to pay each month, the lender will divide your annual property tax obligation by 12. In the scenario that property taxes end up being higher than what you have paid throughout the year, you will be required to make an extra payment to cover that amount.

Refinance calculator

For more information or to perform calculations that involve paying off a credit card, use the Credit Card Calculator or use the Credit Cards Payoff Calculator for paying off multiple credit cards. The amortization chart shows the trend between interest paid and principal paid in comparison to the remaining loan balance. Based on the details provided in the amortization calculator above, over 30 years you’ll pay $351,086 in principal and interest.

Reducing monthly mortgage payments

The mortgage rate decides how much interest you will have to pay the lender throughout a loan’s life. A higher mortgage rate means higher interest expenses, which is why every borrower should aim for the lowest mortgage rate possible. While PMI is used for conventional mortgages, MIP or Mortgage Insurance Premium is used for non-conventional mortgages, such as for FHA loans.

Once you have a loan, you pay it back in small increments every month over the span of years or even decades. It’s essentially a long, life-changing IOU that helps many Americans bring the dream of homeownership within reach. In the early 20th century, buying a home involved saving up a large down payment. Borrowers would have to put 50% down, take out a three or five-year loan, then face a balloon payment at the end of the term. Once you know what range you can afford, you can reach out to a lender to get pre-approved. Pre-approval is a formal process where you submit documents to a loan officer and receive an actual estimate of how much they could potentially lend you.

If your lender does not offer the opportunity to make bi-weekly payments or it offers it at a high cost, you can create your own bi-weekly mortgage plan. A lot of discipline and commitment will be needed on your part to be able to follow a bi-weekly payment plan on your own and get some of its benefits. The home affordability calculator provides you with an appropriate price range based on your input. Most importantly, it takes into account all of your monthly obligations to determine if a home could be comfortably within financial reach. To calculate how much house you can afford, we’ve made the assumption that with at least a 20% down payment, you might be best served with a conventional loan. However, if you are considering a smaller down payment, down to a minimum of 3.5%, you might apply for an FHA loan.

Before signing the documents, make sure to ask questions on any concerns that you have or clarifications that you may need. The Loan to Value ratio is the portion of the house’s price that is being financed through the mortgage. The LTV ratio is calculated as the mortgage amount over the house’s price. When one makes a smaller down payment, the mortgage amount needed to purchase the house is larger, and therefore the LTV ratio is higher. When lenders evaluate your ability to afford a home, they take into account only your present outstanding debts. They do not take into consideration if you want to set aside $250 every month for your retirement or if you’re expecting a baby and want to save additional funds.

No comments:

Post a Comment